When it comes to investing and generating wealth, I’ve always stressed a long term view that requires to keep the following things in check.

- Emotions

- No investor can be successful if he/she gives in to a market in free fall by selling their positions for a steep loss due to lack of liquidity or panic selling.

- Patience

- Successful investing requires a mindset knowing that bear and bull markets come and go and each present equally lucrative opportunities – it all comes down to your mindset.

- Adapting

- As an enterprising investor, a changing world requires you to tweak strategies, without compromising the one true long term goal that really matters in investing – generating profits & creating wealth. The COVID-19 outbreak is an ongoing black swan event that reminds me to continue incorporating new ways I invest in companies, while keeping my long term horizon in mind and sticking to many of the fundamental strategies I’ve explained previously. In addition to my value investing & long term strategies, I’ve been motivated to become more enterprising. Here’s what that means.

Wall Street analysts and many institutional investors have long believed in the FAANG stocks, hence these companies (and then some) get widespread coverage.

- F- Facebook

- A- Amazon

- A- Apple

- N- Netflix

- G- Alphabet (formerly, Google)

Recent market conditions reassured that these “growth” stocks are highly vulnerable during bear markets and often times, the first to sell off due to higher than average valuations. Fighting the status quo means defying norms on Wall Street and avoiding to chase the Netflix’s and Google’s of the world. Think about it – they are already well established and highly profitable companies. Being enterprising requires knowing that these companies likely have limited profit potential and at some point, are likely to cap out on revenue & profits, unless unique M&A strategies are implemented. Don’t get me wrong – I’m not saying these are not wise investments, just saying that a lot of the good news and future prospects about these companies are already forecasted on Wall street due to heavy analyst & media coverage. These are no longer “under the radar” companies. I highly recommending reading “The Intelligent Investor” by Benjamin Graham. Graham was a long time mentor to Warren Buffet and he seamlessly explains unique investing strategies that are not status quo on Wall Street.

Defying Status Quo:

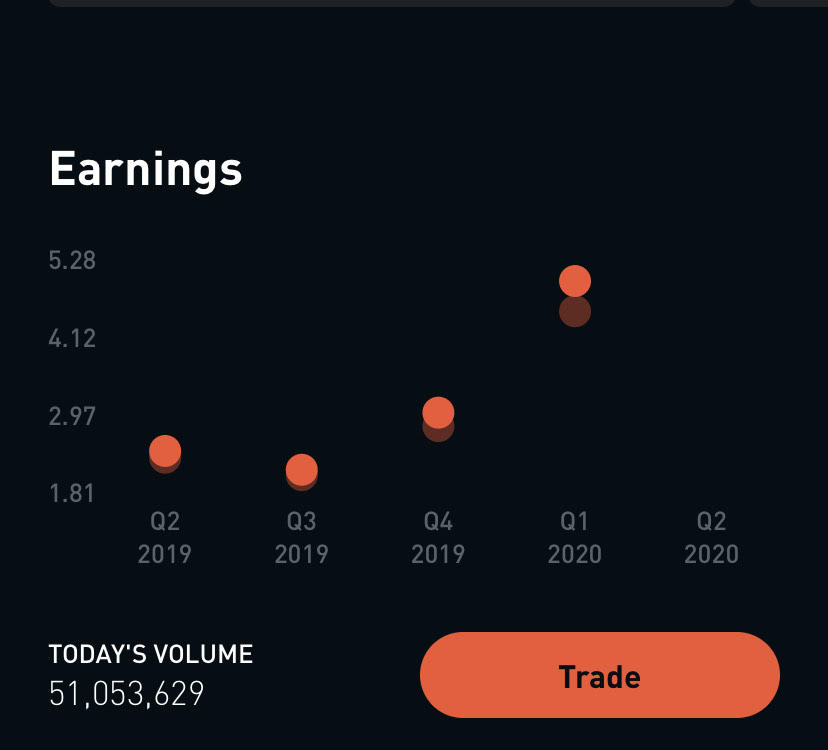

Being an enterprise investor requires dedication & time in hopes of finding the next FAANGs. One neat trick that I’ve found on Robinhood (a commission-free investing platform) is looking at the volume of shares traded for a given company on days there was high volatility. See below for a comparison of a FAANG stock vs. a non-FAANG stock. You can easily guess which one is a FAANG vs. non-FAANG.

To be able to see significant or outsized gains over your lifespan, it is essential to incorporate the enterprise mindset. This strategy is not for the investor who doesn’t want to spend a lot of time doing research or closely monitor US financial markets. This strategy IS for the investor who treats their investments as if they are putting money into their own business in hopes to see it grow and prosper over their lifetime. Lastly, this strategy is also not for the conservative investor who wishes to focus purely on index funds/mutual funds/ETFs and other fixed income investments etc.

This mindset involves looking at unknown or lesser known companies in the US. As with any investment, the fundamental strategy of analyzing the company’s balance sheet and income statement for their liquidity/cash position & revenue and earnings growth, respectively, comes in. The enterprising investor will invest in these companies that have little to no coverage on Wall Street – before all the potential good news start coming in. Take a company like Garmin, for example. Most of you reading this will think of Garmin as the old-school GPS company that your mom or dad used in the car on a road trip you took fifteen years ago. However, over the last few years, this company has been making great strides in wearables technology and has strongly delivered on its promises. But Wall Street has very little coverage on these types of companies. This is just one example of the ample number of companies that exist in Corporate America that are under the radar and don’t get much attention from Wall Street.

Unlocking potential:

I may be wrong, however, the FAANGs have delivered so much value to date that their long term potential remains limited. Their businesses remain sound & liquid and will likely remain that way for decades to come. However, under the radar companies have yet to be discovered for their limitless potential due to their small size today and have prospects to compete with the FAANGs one day. These companies can also be defined as having a smaller market cap than other big businesses. Smaller cap names have much more room to grow than megacap names such as Apple or Microsoft.

Boring is good:

Under the radar names are boring and their lack of popularity doesn’t excite Wall Street. Excitement is driven by analyst coverage & upgrades and typically, under the radar companies don’t fit the bill. An example is Waste Management – who wants to invest in such a dismal name? However, this company is fairly simple and easy to understand and has a very straightforward business. Under the radar companies can also be characterized by low volatility, making them more attractive in times of a recession.

Learning to appreciate volatility:

Time is the single greatest asset for an investor. If used wisely, the effects of compounding will continue to benefit the individual investor over time, despite a bull or bear market. As fears of increasing volatility grow during the COVID-19 pandemic, Wall Street gurus often resort to fear mongering and make their viewers think that the world is ending and that investors should fear what happens next and not buy into equities. That’s status quo on Wall Street and you know better than that. Fighting the status quo means staying the course, being patient, & most importantly, keeping emotions out of sight when investing into high quality companies.

DISCLAIMER:

This blog and the information contained herein is not a platform for guaranteed success on investments. The companies I mention in my posts are NOT recommendations for investments. The views expressed are my own and I strongly suggest to do your own research prior to making any decisions. Because the information on this blog is based on my personal opinion, research, and experience, it should not be considered professional financial advice. The blog is a discussion forum and not a website for access to financial data. I have no access to material non-public information nor any discrete information on publicly traded companies.