If you closely follow US markets, you know that nearly every sector in the economy YTD has notched respectable gains. Financials, Technology, Health care.. you name it, until these past two weeks. A world of easy monetary policy has further strengthened investor optimism and financial markets continue to weather any storm that comes their way- whether its US tensions with Iran, tariffs with China, or even potential unforeseen events such a potential credit crisis.

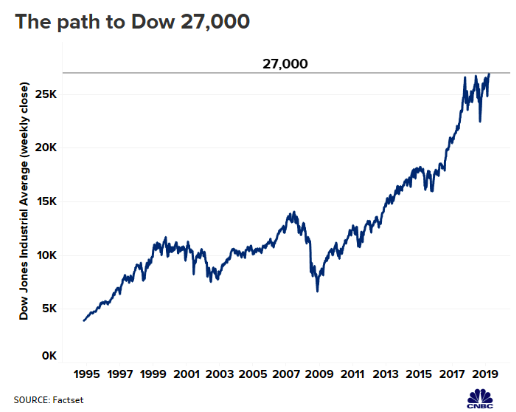

The Bull case: The Dow Jones Industrial Average, made up of 30 large cap US companies, recently crossed 27,000 for the first time and has declined a bit from that peak. The tech heavy Nasdaq composite, notched a record high as well, easily surpassing the 8,000 level and then recently shifting downwards. How did we get here? In my opinion, the below are a few reasons and what they mean for your money:

Loose monetary policy: A near breakdown of the financial system in the 2007-2008 recession called for a lower interest rate environment. In simple terms, a lower interest rate policy makes life easier for borrowers as it lowers the cost of borrowing money, thus increasing spending and keeps the economy afloat in periods of distress. The below shows the benchmark interest rate in the US for the past few decades.

Corporate earnings: Strong quarterly earnings reports have pushed the indices higher. The biggest tech names like Google, Facebook, and Microsoft all easily exceeded earnings expectations and thus pushed the Nasdaq to an all-time high.

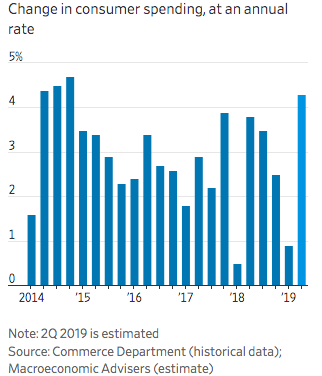

Consumer Spending: According to the Bureau of Labor Statistics, consumer spending accounts for 60-70% of the US economy. Recent reports indicated that the US consumer continues to impress and there appear to be little signs of concern of a significant slowdown in the US growth picture.

What does the above mean for your investments? Well, if you’ve stayed invested over the last 3-4 years and have bought during corrections, you were smart to do so and likely experienced significant gains that followed. Trump’s pro-business policies have further advanced the bull case for stocks and that trend should likely continue, given that geopolitical headwinds, tariffs, and credit crisis’ stay away. If you hesitated in investing in the stock market, you missed out on the following: 70% overall gain in the Dow Jones Industrial Average and 81% overall gain in the Nasdaq ever since Trump’s election.

I will repeat the mindset constantly- reliance on income solely from your job is not enough, unless you’re an ultra high net worth individual. Even then, your job is not guaranteed forever and thus you want to ensure that you have your money continuously working for you as much as (if not more) you’re putting in the hours to earn dollars at work. Diversify, diversify, diversify- can’t stress it enough. By diversifying in this scenario, I’m saying to look for different growth engines for your money as you earn it. Contributing the max to your 401K or 403B (to the extent of employer match), keeping a good chunk of your savings in your personal portfolio (Vanguard, Fidelity, or Scottrade etc.), Robinhood, or an online savings account that generates at least 2% annually. Whatever you do, don’t ever keep more than your average monthly bill cost in your bank account. Keeping your cash on different platforms allows for growth and diversification of your net worth at all times (in a market over the long term).

I’d be a fool to tell you to be optimistic at all times when it comes to investing in the stock market. There are always headwinds in the market, and it is almost impossible to figure out the outcome of those headwinds, should they happen. If only we could predict when the stock market was going to fall or rise- we’d never have to work a day in our lives again. I present the bear case below.

A bear market is a period of decline in the stock market (by definition, 20% or more decline from the peak in the market and a period of pessimism and fear amongst investors). A prolonged bear market generally leads an economy into a recession. As you know, a recession is followed by high unemployment, low productivity, and sharp declines in the broader financial markets. A correction is a period of temporary decline of the major indices and is defined by a 10% or more decline. From previous experiences, some periods during the year are more volatile than others. As it gets closer to the end of the year (starting around August- October) historically, they tend to be the most volatile months of the year due to investors taking profits off the table before year end and taking advantage of any capital losses (up to $3,000 deduction per year). However, recently, geopolitics has taken the world by storm and the global economy currently faces a multitude of problems to solve. I present the most significant ones to be aware of as you invest over the next few months:

US-China trade relations: An ongoing issue that can’t be solved anytime soon unless a fair deal is put on a table. Tariffs from both sides of the table have dismantled the global supply chain of trade and a bigger challenge is now on the horizon- the Yuan. The Chinese recently started using their currency as a tactic to make China more competitive in the global market as a means to prevent the US from having the upper hand and with intention for them to come to the negotiation table. As a result, investors were spooked and the market has once again become volatile. My personal strategy? Have easy access to cash and hold in an account where you can immediately transfer in case the market continues south from here. Historically, the individual investor has fared well if he/she bought well established companies that had significantly declined from their peak stock price. Remember: Be greedy when others are fearful, and be fearful when others are greedy. In essence, you should always want to take advantage when corrections happen. There is no way to time the market so it is impossible to make a call if a market has bottomed or peaked- you’ll never be right. In essence, you want to purchase a solid company that has a well established business with multiple revenue segments and good cash flow and pays a good dividend.

Iranian oil: In mid-June, Iran attacked two oil tankers in the busiest supply route in the world for trade- the Strait of Hormuz. Just weeks later, an unmanned US drone was shot down. Ever since, crippling sanctions on Iran have continued. What’s worse, countries that do business with Iran for oil (ie. India and Japan) have been penalized for purchasing Iranian oil. The strategy was to cut off Iran economically and attacking where it hurts most, by preventing oil exports. This is another concern to be mindful of as you modify your investing strategy to tackle volatility in the market. Tensions in the Middle East have always been a geopolitical concern, and so similarly, this time is no different.

A bubble in the US: This is probably the worst case scenario and a crisis could hit home, if not from elsewhere. Not a question of if, but a question of when. The economy could plunge further for the following reason: Debt. Sure lower taxes are nice, but not when your country is already drowning in debt. The US has recovered well since the financial crisis, thanks to swift moves in monetary policy and low interest rates. However, a healthy economy can handle higher interest rates and higher taxes and theoretically, we should have increased interest rates years ago. US treasuries are considered a safe haven of the world and the US Dollar still continues to be the most powerful currency in the world. But – can the good times continue to roll? I don’t think so. The level of debt to percentage of US GDP is rising at an alarming rate. A long term expansion should happen freely and not be manipulated through easy monetary policy and low interest rates. Continuing to cut taxes and thereby, increasing our deficit, we are setting ourselves up for a doomsday scenario. Debt will continue to expand and at some point, if the problem is not mitigated, the US could be in a scenario where we will ultimately default on our payments. Who’s going to pay for Social Security? Pensions? Health care? Student loans? I can tie this on a smaller scale to the average Joe: living beyond your means is great (for short term), until it comes time to foot the bill and you don’t have money to show for it.

In summary, financial markets should operate freely and without disturbance from manipulative monetary policy, which is currently happening all around the world in major economies- USA, UK, Japan, India have all cut their benchmark interest rates. My thought is that major economies are playing the defensive game and preparing for an economic decline. What’s concerning however, is why we’ve had low interest rates for so long to begin with, despite being in favorable economic conditions. At least in the short term, I strongly recommend to have easy access to cash to invest in the stock market and prepare for more volatile months ahead. As I mentioned, the fall season tends be the most volatile. And if recent geopolitical events are any indication, expect a mix of sharp losses and gains on a day to day basis.

Disclaimer: This blog and the information contained herein is not a platform for guaranteed success on investments. The views expressed are my own and I strongly suggest to do your own research prior to making any decision. Because the information on this blog is based on my personal opinion, research, and experience, it should not be considered professional financial advice. The blog is a discussion forum and not a website for access to financial data. I have no access to material non-public information nor any discrete information on publicly traded companies in general.